2025’s Market Inferno: Conquer the Chaos to Thrive in the Second Half

Your Rebel’s Roadmap to Crushing the Second Half’s Wild Ride

Key Points

A potential dead cat bounce of 5-10% may occur in mid May to early June 2025, but it’s likely a trap before sharper declines.

The S&P 500 could face significant drops in June-July and September-October, with a recovery possibly starting in November.

The economy may hit rock bottom in October-November, lagging the market’s earlier rebound.

Trump’s tariffs, China’s resistance, and Fed QE are key drivers, but policy delays add uncertainty.

May-June Dead Cat Bounce

It seems likely that the S&P 500 could experience a temporary rally, or “dead cat bounce,” of 5-10% from late April to early June 2025. This bounce may be driven by short-term optimism from tariff negotiations or Federal Reserve signals, but it’s not expected to last. No significant bounce is anticipated later in June, as economic pressures and trade tensions likely trigger declines.

Broader Market Outlook

From late April to November 2025, the market may face sharp volatility, with major declines in June-July and September-October, potentially followed by an early recovery in November. The economy, however, is likely to lag, hitting its lowest point in October-November due to housing and job market struggles.

How to Prepare

Keep cash reserves high, diversify into stable ETFs like consumer staples (XLP), and monitor economic indicators like jobless claims. Be ready to buy during the lowest low months for potential 2026 gains, but avoid chasing short-term rallies.

Brace for Impact: The Second Half’s Wild Ride Begins

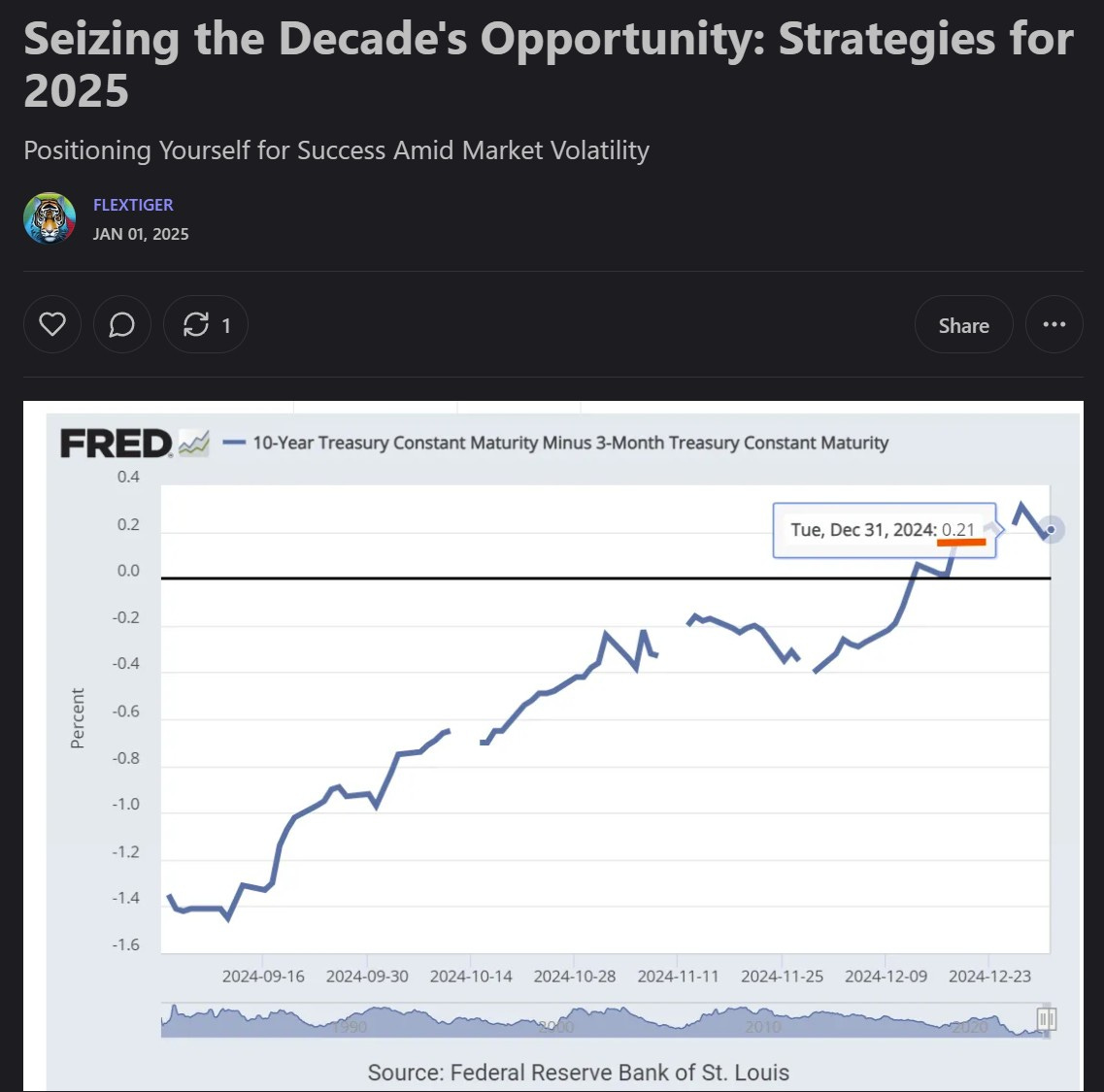

They never see the first wave coming. That’s the market’s cruelest trick—when a rally sparks, the crowd’s still licking wounds from the last bear, sneering at “dead-cat bounces” and betting on collapse. In our January 2025 newsletter, we warned of a volatile first half, with liquidity squeezes, tariff threats, and a steepening 3m-10y yield curve (from -1.52% to 0.21%) flashing recession warnings. We urged you to lean into resilient sectors like technology and renewables while clutching safe havens like gold. Now, as we barrel into the second half of 2025, that storm’s only getting fiercer. A sneaky 5-10% rally might tempt you in May to early June, but don’t be fooled—it’s a trap, a fleeting calm before the real chaos hits. Ready to outsmart this maelstrom and profit where others panic? This is your battle plan to conquer 2025’s market madness.

Want to stay ahead of the chaos? Subscribe to my newsletter for exclusive insights and strategies to thrive in turbulent times.

The Global Reckoning: A Storm Like No Other

Forget calm waters—2025’s second half is a Category 5 economic hurricane. Our January newsletter flagged the 3m-10y yield curve’s shift to 0.21% by December 31, 2024, as a recession red alert, and recent data showing volatility (e.g., -0.05% by April 8, 2025) only amps up the danger. This isn’t just turbulence—it’s a full-blown economic reckoning. But here’s the kicker: in this chaos lies a once-in-a-decade chance to snag undervalued assets. Will you cower as markets quake, or will you pounce when the herd flees? The bold will feast while the timid starve.

Market Flashpoints: Navigating the Waves of Chaos

The S&P 500’s second half is a rollercoaster designed to shake out the weak. As of April 26, 2025, it’s perched at 5,525.21, with a P/E ratio of 27.14—a valuation bubble begging to burst Yahoo Finance Multpl.com. Elliott Wave theory, our map of market psychology, reveals a brutal path from late April to November:

May to Early June: A 5-10% pop from April’s lows, sparked by Trump’s 90-day tariff pause and Fed QE whispers. Investors, stung by April’s dip, will dive in, thinking the bear’s done. Wrong. This dead-cat bounce is a trap, and no rally’s coming later in June—mid-June unleashes hell.

Mid-June to July: A savage 35% plunge as China’s 84% counter-tariffs choke supply chains and housing data craters. Algorithmic trading (95% of volume) fuels a panic-driven sell-off.

August-September: An 8-10% bounce as Canada and Mexico may agree to sign tariff deals and the Fed’s QE machine hums. It’s a mirage—don’t buy the hype.

September-October: A 20-25% gut-punch, with unemployment at 6.5% and bank lending down 15%. A global crisis peaks, and policy delays crush hope.

November (Early Recovery): A 10-15% climb as $500 billion in QE and China’s tariff concessions stabilize markets. The economy’s still drowning, but the market’s betting on 2026’s dawn.

Battle Plan: Outsmarting the Market’s Deceptions

Surviving 2025 isn’t about outsmarting the market—it’s about playing the odds like a Vegas shark. Here’s your playbook:

Hoard Cash: Keep 30-40% in T-bills (~4% yield) to pounce on October’s lows. Cash is your lifeline when markets bleed.

Diversify Ruthlessly: Spread bets across XLE, XLK, XLP, and XLV. Single stocks are a death trap in this volatility.

Watch the Triggers: Heightened jobless claims scream recession. Tariff headlines and Fed moves are your compass.

Strike in October: When the market bottoms, grab the right assets for 2026’s rebound. Patience is your edge.

Don’t get caught flat-footed. Subscribe to my newsletter for real-time updates, insider strategies, and the edge you need to thrive in 2025’s chaos. Join now and stay one step ahead.

Decoding the Madness: Why This Matters

This isn’t just numbers—it’s a masterclass in human folly. Behavioral finance, monetary theory, and game theory reveal markets as a cauldron of greed, fear, and delusion. By charting these waves, we’re not fortune-tellers; we’re codebreakers, giving you the tools to outmaneuver the mob. Will you watch the shipwreck or steer through the storm?

This is a tale of raw human grit—deserted construction sites, unsold D.C. mansions, and families bracing for layoffs. But it’s also about the fire that burns when markets pivot, the stubborn hope that pierces panic’s veil. Every crash is a reset, a chance for the bold to rewrite their future.

No storm lasts forever, and 2025’s chaos will pass. Markets cycle, crashes birth bargains, and resilience wins. With sharp eyes and iron will, you can turn this maelstrom into your triumph, grabbing assets the herd abandons. The darkest nights forge the brightest futures—step into the fray, and claim your stake in 2026’s dawn.

Disclaimer: This newsletter is for educational and entertainment purposes only and is not financial advice. Markets are unpredictable, and risks abound. Consult a qualified financial advisor and conduct your own research before making investment decisions.

Follow me on X and Bluesky for more real time posts on navigating this storm.