How to Overcome the Inflation-Debt Paradox with AI Prosperity

Leveraging the super-enhanced productivity to reshape our economy into one where growth, low-to-no inflation, and debt reduction go hand in hand.

Imagine a new world where the same $100 bill can buy you significantly more goods and services than it does today, thanks to the deflationary impact of hyper-productivity. In this world, the Federal Reserve can lower interest rates without fear of stoking inflation, subsequently reversing the national debt and freeing up resources for growth and innovation.

But Now, Face the Economic Labyrinth Before Us

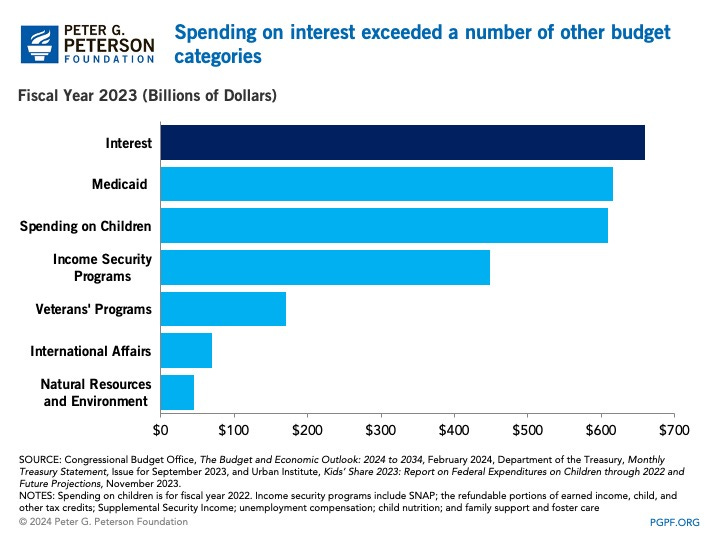

The current economic landscape is akin to navigating a impossible maze, where every turn presents the challenge of balancing inflation control with fostering economic growth, all while managing an ever-increasing national debt. The traditional tools wielded by the Federal Reserve, primarily the manipulation of the federal funds rate, have historically oscillated between stimulating growth and tempering inflation. However, this delicate equilibrium has been disrupted, evidenced by the unprecedented situation where the Fed was unable to transfer funds to the Treasury first time in history, and the national debt is projected to climb to a record 116% of GDP by the end of 2034, underscoring the urgency for innovative solutions to the burgeoning issue of national debt and its implications on fiscal policy.

The Quest for a Sustainable Solution

The critical challenge lies in recalibrating the federal funds rate to stimulate economic activity without igniting inflationary pressures. This task involves a nuanced understanding of the velocity and magnitude at which rate adjustments can be made to cool an overheating economy without stoking the fires of inflation. The theoretical underpinning for this approach finds roots in the Keynesian economic model, which advocates for active government intervention to manage economic cycles. The model suggests that carefully calibrated fiscal and monetary policies can stimulate demand and growth in times of economic downturn, while controlling inflation during periods of expansion.

Strategizing Interest Rate Adjustments

Aiming for an interest rate slightly above the long-term inflation goal of 2% emerges as a strategic solution. This approach aligns with the Fisher Equation, which delineates the relationship between nominal interest rates, real interest rates, and expected inflation. By setting rates that are modestly above the inflation target, the economy can achieve moderate growth and employment gains without precipitating inflationary pressure. Moreover, this strategy facilitates a more sustainable framework for managing national debt, alleviating the fiscal strain on the Treasury.

The AI Catalyst: Transforming Economic Dynamics

The advent of artificial intelligence (AI) and Artificial General Intelligence (AGI) introduces a paradigm shift. As Cathie Wood of Ark Invest suggests, these technologies are poised to serve as significant deflationary forces. The productivity boom fueled by AI—akin to the transformative impact of the Industrial Revolution—promises to elevate economic efficiency to unprecedented levels. This scenario is supported by Solow's productivity paradox, which observes that technological advancements initially may not reflect in productivity measurements until a significant integration period has passed. AI and AGI's full potential to revolutionize productivity and economic activity mirrors this concept, suggesting a future where the paradox is resolved, and productivity gains significantly outpace historical trends.

Enhancing Purchasing Power Through AI

In this new economic order, the concept of money itself undergoes a radical transformation. The deflationary impact of AI, coupled with its ability to exponentially increase productivity, could lead to a scenario where nominal inflation targets are maintained at 2%, yet the real inflation experiences a downward pressure, potentially reaching negative territories. This phenomenon is explained through the lens of the Quantity Theory of Money, which posits that the money supply's velocity and the volume of goods and services produced in an economy influence the price level. AI-driven productivity increases the volume of goods and services, thereby increasing the purchasing power of money.

A New Economic Renaissance

The emergence of an AI and AGI-driven economy not only promises to revolutionize our current financial systems but also fundamentally alters our understanding of money, interest, debt, and wealth. This shift introduces new economic theories and business practices, challenging and eventually replacing outdated models. The once-daunting challenge of national debt becomes a solvable problem, gradually clearing the path toward a future of financial stability and prosperity.